European imports of textile travel accessories have increased steadily. Between 2014 and 2018, the average growth was 7.9%, which is higher than the growth in global imports of travel accessories made of textiles during the same period. This increase is expected to continue and makes Europe an interesting potential market for you.

Product description: Travel accessories made of textiles are a group of products, rather than one specific product. Within the home sector, travel accessories made of textiles are usually included in the leisure category.

The product group of travel accessories made of textiles includes:

- Duffel bags: large cylindrical bags made of textiles or other materials used by people who travel for carrying their belongings

- Backpacks: textile sacks carried on one's back and secured with one or two straps that go over the shoulder(s).

- Laptop sleeves: generally thought of as a thin fabric case intended to protect a laptop from scratches or bumps when carried around.

- Etuis: small bags made of textiles or other materials that are used to carry small articles, such as pencils or toiletries.

Since the product group is diverse, duffel bags and laptop sleeves will be considered the key products in the category of travel accessories made of textiles and will be analysed further in this product factsheet.

Classification of travel accessories:

4202.1291: travel goods, similar containers made of textile materials, or of other materials, including vulcanised fibre

4202.1299: travel goods, with an outer surface made of textile materials

4202.2290: handbags, with outer surface made of textile materials

4202.3290: articles carried in a pocket or handbag made of textile materials

1512.1220: handbags of leather, composition leather, patent leather, plastic sheeting, textile materials or other materials (including those without a handle).

Quality:

- Functionality: The main purpose of travel accessories is to provide storage and protection while travelling.

- Raw material quality: Travel accessories can be made of many different fabrics, both natural and synthetic.

- Durability: It is very important that the fabric used is durable. The travel accessory should be able to protect what is stored inside from being scratched or broken.

- Design: All shapes and sizes are allowed. It is therefore wise to communicate to your potential European buyer, the sizes (or ranges) that you are able to produce during the early stages of collaboration.

1. What makes Europe an interesting market for travel accessories made of textiles?

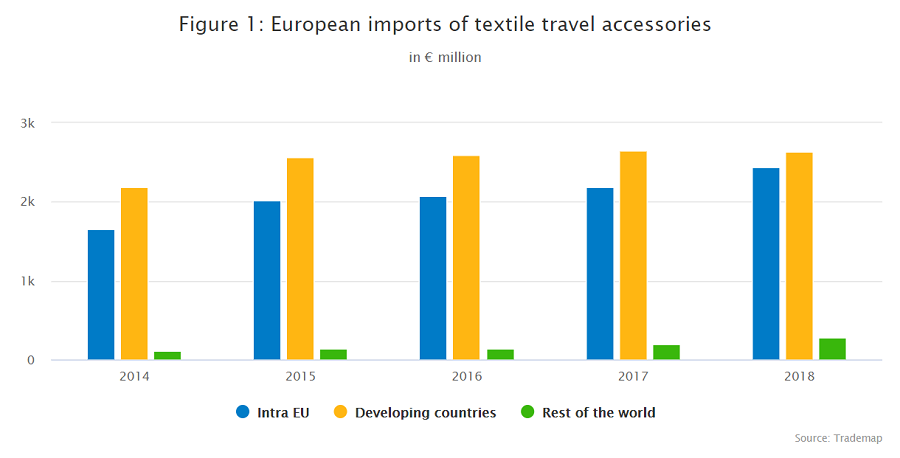

European imports of textile travel accessories have grown considerably since 2014, although imports from developing countries have stabilised since 2015. As shown in Figure 1, developing countries continue to be Europe’s main suppliers of textile travel accessories.

Figure 1: European imports of textile travel accessories/ in € million

After a drop in 2013 and 2014, the market recovered, reaching a total import value of €5.4 billion in 2018. Between 2014 and 2018, the average yearly growth rate is 7.9%. This growth is expected to continue over the next few years, which offers opportunities for exporters from developing countries.

By comparison, global imports of travel accessories made of textiles grew at an average rate of 6.9% between 2014 and 2018. European imports of travel accessories made of textiles accounted for 38% of the total global imports of travel accessories made of textiles.

The rising popularity of travelling is driving the market growth in Europe. Ongoing trends such as sustainable, intelligent and lightweight travel accessories are also expected to further boost the market of travel accessories made of textiles in Europe.

In 2018, 49.3% of the total European imports came directly from developing countries. Although that figure is lower than in the previous years (54% in 2016 and 53% in 2017) developing countries remain the main source of imports. This presents opportunities for you as an exporter from developing countries. As shown in Figure 1, internal European trade is also seeing an increasing trend, which points to dynamic trade between the European countries.

3. Which European countries offer most opportunities for travel accessories made of textiles?

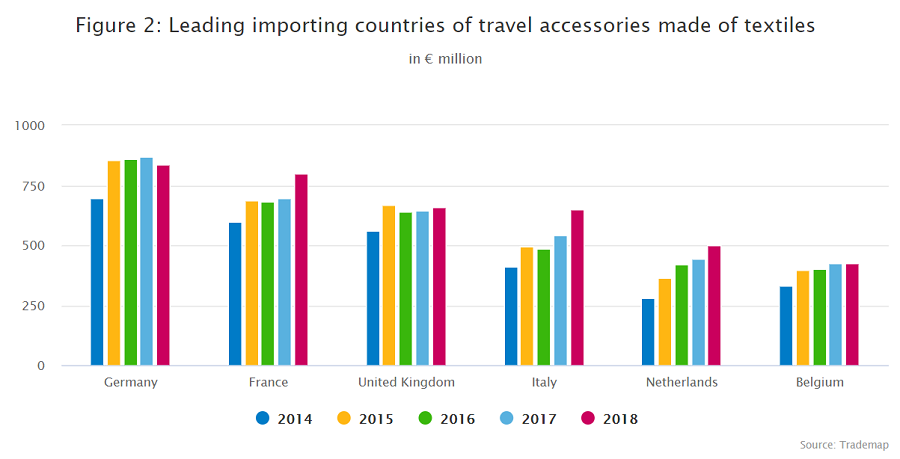

In 2018, Germany remained the key European market for travel accessories made of from textiles, accounting for 16% of total imports. The country is closely followed by France (15%) and the United Kingdom (12%). Smaller, but growing importers of travel accessories made of textiles are: Italy (12%), The Netherlands (9.3%), Belgium (7.9%)

Figure 2: Leading importing countries of travel accessories made of textiles/ in € million

Explanation:

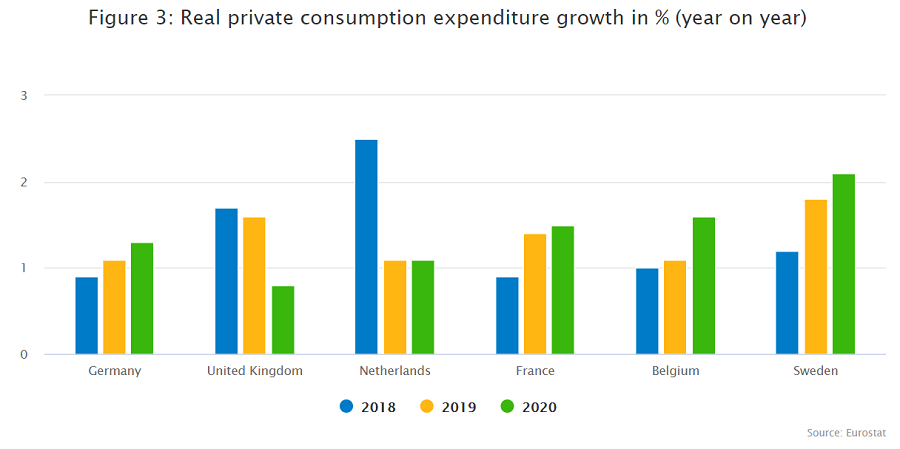

Projections for real private consumption expenditure modest at best

Private consumption expenditure includes all purchases made by consumers, such as food, housing (rents), energy, clothing, home accessories, health, leisure, education, communication and transport, as well as hotel and restaurant services. It is an important indicator for the European travel accessories market. The sector is closely linked to economic cycles. When economic circumstances and prospects are dim, consumers postpone buying non-essential items and delay their travel plans. Conversely, when economic conditions are favourable, private consumption expenditure and purchases of these products surge.

In 2019 and 2020 most of the leading import countries are projected to have a lower level of private consumption expenditure compared to 2018, due to an economic slowdown. In 2020, growth is likely to stabilise. Exceptions are the United Kingdom, which is expected to witness a further drop due to the withdrawal of the United Kingdom from the European Union (Brexit).

Figure 3: Real private consumption expenditure growth in % (year on year)

Germany, the main European market for travel accessories made of textiles

As shown in Figure 2, Germany is the leading European importer of travel accessories made of textiles, with an import value of €835 million in 2018. Between 2014 and 2018, the average increase in the import value was 4.7%. Unlike in the other major European markets, the growth turned slightly negative in 2018. However, this is not expected to be a structural decline. When it comes to imports from developing countries, Germany was also the leader with an import value of €369 million in 2018. This is 44% of the total import value.

Germany is Europe’s largest economy and is home to 16% of the European Union’s population. The German economy is widely considered the stabilising force within the EU. Between 2010 and 2018, the German economy grew at a rate of more than 2%. This is a higher rate than that observed in the United Kingdom, France and Italy.

Private consumption expenditure in Germany is forecast to increase, which means that conditions are favourable for an increased consumption of textile travel accessories. The combination of the large share of imports from developing countries, the projected growth in private consumption expenditure and the country’s stable economy, mean Germany will remain an interesting market for the foreseeable future.

Strong growth in imports from developing countries in France

France is the second largest importer of travel accessories made of textiles with an import value of €800 million in 2018. Between 2014 and 2018, the average increase was 7.6%. In 2018, the growth peaked at 15%. France is responsible for 15% of the total European imports of travel accessories from textiles of which €309 million, or 39%, comes directly from developing countries. Between 2014 and 2018, the average growth of imports from developing countries was considerable at 12% per year. As such, exporters from developing countries outperformed other suppliers.

Although economic growth in France has slowed down and global uncertainties and the effects of social unrest weighed on consumer confidence in 2018, projections for 2019 and 2020 are positive with an increase in private consumption expenditure expected. It is likely that these positive forecasts will have a favourable impact on the demand for travel accessories made of textiles. As a result, there will continue to be new opportunities for exporters from developing countries.

More than half of imports to the United Kingdom come from developing countries

In 2015, the UK’s import value peaked at €670 million. The year after, imports decreased to €642 million, but staged a steady comeback in the subsequent years. In 2018 the import value was almost back at the 2015 level, at €660 million.

The average growth between 2014 and 2018 was 4.1%. More than half of the imports originated from developing countries (54%). In combination with the growing import value, this makes the United Kingdom an interesting market for exporters from developing countries.

Although modest economic growth is projected for 2019 and 2020, Brexit is expected to continue to have a negative impact on the United Kingdom’s consumer confidence throughout 2019 and 2020. This is also reflected in the private consumption growth, as shown in Figure 3. The growth in consumer expenditure is going down and it is likely to have an impact on the demand for travel accessories made of textiles. On the whole, while the share of imported travel accessories made of textiles from developing countries is high, the prospects for exporters from developing countries for the next few years are uncertain and may be modest at best.

Stagnating market in Italy

Italy quickly recovered from a decline in 2014, with a total import value of €493 million in 2015. Between 2014 and 2018 the average growth was 12.2%, reaching €650 million in 2018. The country is responsible for 12% of the total European import value. In 2018, imports from developing countries accounted for 43% of the total import value and the average growth rate between 2014 and 2018 was positive (6.8%)

However, the Italian economy has been broadly stagnant for the last five quarters and projections for the near future are not very optimistic. The European Commission’s forecast indicates that Italy will record economic growth of just 0.1% in 2019 and 0.7% in 2020, which would make it the slowest-growing EU economy in both years. In line with the economic performance, Italian private expenditure growth is forecast to increase slightly in 2020 compared to 2019. Since the difference is minimal, it is not expected to have a significant impact.

Considering the weak economic forecasts, it is expected that opportunities for exporters from developing countries are likely to be modest at best in the short term.

The Netherlands, the biggest climber in imports of travel accessories made of textiles

Accounting for 9.3% of total European imports of travel accessories made of textiles, the Netherlands is the fifth-largest market. Between 2014 and 2018, the Netherlands saw a significant increase in import value with an average growth of 16% per year. In 2018 the import value reached €501 million, compared to €279 million in 2014. In 2018, almost 72% of imports came from developing countries, which equals €360 million in value terms. The Netherlands is the biggest climber when it comes to average growth per year. In combination with the high percentage of imports originating from developing countries, this offers interesting opportunities for exporters from developing countries.

However, private consumption expenditure growth in the Netherlands is forecast to drop from 2.5% in 2018 to 1.1% in 2019. The Brexit, in addition to the international trade disputes between the United States and China, have a big impact on the Netherlands. The country is strongly dependent on international trade and negative developments in that respect have an amplified effect on the country’s economic performance. This will likely have an effect on economic growth, consumer confidence and the country’s resulting consumption of travel accessories made of textiles.

At the same time, it should be noted that the impact on imports of travel accessories from textiles extends beyond the country itself, since the Netherlands is a big re-exporter of goods. As such, developments in other European countries will also play a role. Given the economic slowdown in Europe as a whole, a sharp increase in imports is not expected. However, a decrease is not likely, either, since the economies will still grow, albeit at slower pace.

Belgium relies heavily on imports from developing countries

Although Belgium is the smallest of the six countries in terms of import value, it saw a sizeable average growth of 6.6% per year. The most interesting thing about this market is that in 2018, €347 million of the total import value came from developing countries. This equals 81% of the total import value of €425 million. Whilst imports from the rest of the world declined by 17% per year, imports from developing countries increased by 6.2% per year. This makes it an interesting market for exporters from developing countries.

Belgian private consumption expenditure is also expected to grow significantly in 2020. This will likely have a positive impact on the consumption of luxury items in Belgium. However, consumers in mature markets, like the Belgian market, already spend a fair amount of money on luxury items, so growth in the consumption of travel accessories is expected to be moderate.

3. What trends offer opportunities on the market for European travel accessories made of textiles?

In the European market for textile travel accessories, lightweight accessories and sustainability seem to be the key trends followed by designers and consumers.

Responsible travel accessories

The shift towards sustainability by consumers has influenced designers and producers of travel accessories. Suitcases made of recycled carpet and laptop or smartphone sleeves made of recycled yarns, are trendy items for travel accessories. For this product group sustainability means more than just using “green materials”. It covers the entire lifecycle of the products and includes minimisation of the environmental impact of the production, distribution, use and disposal.

Intelligent, lightweight and fashionable

Travelling is an integral part of everyday life, thus it is important to find solutions for travel accessories to fit the most important items needed for a journey. Being able to travel in a lightweight yet fashionable manner is a growing trend in the European market, where business trips or short vacations are the norm. Therefore, smart textile travel accessories, like hanging organisers or other storage systems, will be very trendy over the coming years.

Etnotek, from Vietnam, is an example of a company that has successfully tapped into these trends. They produce eco-friendly textile backpacks made from 100% recycled plastic bottles.

Source: This study was carried out on behalf of CBI by Globally Cool B.V. in collaboration with Remco Kemper (MDD).