Health / Wellness

As the world around us becomes increasingly complex and people mentally over-challenged, we have a greater longing than ever not only for more safety, but for a feeling of comfort, calm and balance. In this context, the home is gaining signifi cance. The way we live turns into a conscious decision of ever-greater importance. Home is a safe haven into which we can withdraw and pamper ourselves, surrounded by things that give oneself a sense of stability, relaxation and balance. “Taking a major vacation each year will no longer be as important as having a bit of a vacation feeling on an everyday basis – a holiday everyday – creating our own wellness world at home”.

Sustainability

The concept of sustainability rests on three pillars: social, ecological and economical sustainability. In the context of resource scarcity sustainability has gained in priority. It has called for a rethinking of our consumer’s behaviour. The growing awareness of ecological issues has led to an increasing demand for hybrid cars, alternative energies, organic produce, textiles or cosmetics, recycled products, etc. and paved the way for new business ideas and niche markets. Consumers want to know where the items they buy come from, how they are made and how it can affect their health or wellbeing. They are also concerned about the social impact of their consumption: was child labour involved? Are the weaker links of the production chain paid fair wages?

“Sustainability”, “Fairtrade”, “Social responsibility”, “Organic” are all phrases used by the growing awareness of the customer. Customers are well-informed and increasingly conscious of their responsibility and ability to infl uence the market with their day to day purchase choices. People tend to ask more questions about the source and quality of a product. Historically this has been driven by a core group of fair trade importers (members of EFTA) but in recent years there has been a signifi cant growth in newer smaller fair trade importers who have a stronger focus on design and wholesaling and retail, rather than traditional catalogue sales often used by the traditional fair trade organisations. This new emerging fair trade market is particularly active in USA, France and UK. However the concept of fair trade is also being used by more and more established, main-stream importers and retailers to offer products that meet this growing demand of their customers.

Importers who have no experience in a particular country, or existing tradition relationships, often require new suppliers to be a member of WFTO, or require a referral from another WFTO member. Larger retailers however historically have favoured Fair trade label accreditation such is applied to commodity products such as cotton, coffee, tea, etc- In order to communicate its Fair Trade values, smaller producers could consider to become members of the WFTO or consider fair-trade labelling in the future. (There is also a new labelling system being developed for non-commodity products relevant to craft products. This is still in the process of being implemented (SFTMS) but will become increasingly relevant). It is also important to say however that more and more Fairtrade buyers are very design, quality and price conscious and no longer solely rely on their fair trade credentials to expand their markets. Most fair trade organisations are positioned in the mid-market segment which is also very price sensitive. Therefore it is important to stress that design, price and reliability in terms of quality, delivery and communication remain more important to both the fair trade and mainstream markets than any other issues.

Global vs. Local

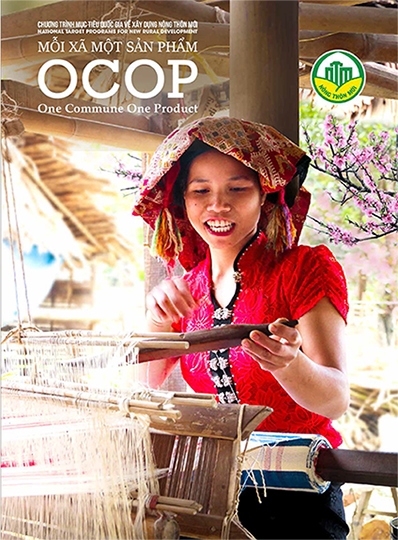

Although the world population has quadrupled in the last century, through modern information and communication technologies, the world has become a village. Globalisation has led to the standardisation of products and has blurred the boundaries of national identities. One can fi nd the same brands all over the world no matter where you are and one does not need to travel to fi nd unique designs from around the world. Trend researcher forecast that the global style is coming to an end, people are tired of mainstream. They are in search of unique and authentic products refl ecting their individual taste. When you buy a product from another country, you want the origin of the product to be recognisable. The biggest challenge for manufacturers will be to rediscover their own heritage and traditional skills and give them a modern twist.

Mobility / Flexibility

In the course of globalisation individual traffi c has substantially increased and we are overcoming distances like no other generation before us. We spend parts of our lives at different places due to a new job or a new relationship or have more than one domicile. The limits between work time and leisure, between family and friends are blurred. Intelligent multifunctional products, modular furniture, items that take space scarcity into account (e.g. foldable) are responding to these new needs.

Aging society

Life expectancy has dramatically increased in the past 50 years while birth rates have declined. The average age of the world population is therefore rising. In Japan the average citizen is aged 42. What about Germany? Consequently the consumption patterns are meant to change: while fast moving consumer goods are bought by a younger demographic - responsible for the success of cheaper retail brands - older people generally spend more but on less items. It is therefore expected that the quality of the consumer expenditure could improve in the future while volumes would decrease. And while younger generations tend to spend more on clothes and leisure, older generations however spend more on housing, food and travel. Many companies have discovered in the meantime the more affl uent 50+ target group. Nevertheless the consumption power of the 50+ may be reconsidered in case of a pension crisis – when the younger working population cannot support the growing retired population anymore.

Safety / control

Climate change, nuclear catastrophes, terrorism, epidemics are new threads to our societies, making us long for more control and safety. In this context stronger regulations are being introduced: car seats for children until 12, the smoking ban, or the motorbike helmet in Vietnam, are just a few examples. It is the same with consumer goods: “safety first”. Consumer protection and product safety are issues that every company has to deal with.

Individualisation

Prosperity, education and mobility lead to a shift of values towards independency and self-fulfi lment. There is a clear trend towards “mass customisation” – clients emancipate themselves from mass production and want to have an infl uence on the manufacturing of their products. Behind the longing for the special and the unusual is the desire to stand out from the crowd. Special, unusual products are evidence of the owner’s individual taste and character and thus earns him recognition. In this context, a valuation for hand crafted products - that convey personality rather than perfection - and a return to old craftsmanship are noticeable. The do-it yourself movement is also gaining popularity: homemade preserves, hand knitted items, grow-your-own, etc.